Superannuation, or “super” for short, is the cornerstone of financial planning for most Australians. It’s the pot of money that will keep you comfortable during your golden years. But with a plethora of super funds out there, how do you pick the one with the lowest fees? This guide will help you navigate the selection process, focusing on a data-driven approach to compare super options.

The Importance of Low Fees in Superannuation

When it comes to superannuation, even a small difference in fees can significantly impact your retirement nest egg.

Here’s why keeping fees low is crucial:

- Compounding Effect: Superannuation benefits from the power of compounding. Imagine your super balance as a snowball rolling down a snowy hill. The longer it rolls (the longer you contribute), the bigger it grows. Fees act like tiny pebbles that get stuck on the snowball, slowing its growth down. Lower fees allow your super to snowball more effectively over the long term.

- Long-Term Impact: Even a seemingly small fee difference can translate into a substantial amount of money over your working life. For example, a 1% fee difference on a $100,000 super balance could equate to tens of thousands of dollars less at retirement.

- Focus on Returns: Lower fees mean more of your super is invested in the market, allowing it to potentially grow through returns. Remember, the primary goal of super is to accumulate wealth for retirement, and keeping fees low allows you to maximize your potential returns.

Here’s an analogy to illustrate the impact of fees:

Imagine you invest $10,000 annually in two different super funds. Fund A charges a 1% annual fee, while Fund B charges a 2% annual fee. Assuming both funds deliver a 7% annual return, here’s the difference after 30 years:

- Fund A (1% fee): Your balance would grow to approximately $790,582.

- Fund B (2% fee): Your balance would grow to approximately $664,388.

As you can see, the seemingly small 1% fee difference translates to over $126,000 less in your super balance after 30 years. This difference becomes even more significant the longer your investment timeframe.

Strategy and Assumptions

Before we delve into the numbers, let’s establish our ground rules and assumptions:

- Investment Strategy: We’ll focus on low-cost international indexed shares, choosing the cheapest version available (hedged or unhedged). Indexed funds passively track a market index, offering broad diversification and typically lower fees compared to actively managed funds.

- Buy/Sell Spread: These are excluded as they’re likely similar across most options and are a one-time cost when entering or exiting an investment.

- Fees Considered: We’ll encompass all relevant fees that eat away at your super balance over time, including fixed admin fees, capped and uncapped variable admin fees, investment fees, and transaction fees. Our focus is on fees directly impacting your account, not those deducted from the fund’s reserves.

- Transaction Fee Calculation: This fee is calculated based on investing the maximum annual concessional super contribution of $30,000, which is a helpful benchmark to compare fees across different funds.

Why Choose International Indexed Shares for Your Super?

This guide has focused on selecting a super fund with the lowest fees for investing in international indexed shares. Let’s delve deeper into why international indexed shares might be a compelling choice for your superannuation strategy:

Diversification:

- Global Exposure: International indexed shares offer exposure to a broad range of companies across developed markets worldwide. This diversification helps mitigate risk by reducing your reliance on the performance of a single country’s economy. Imagine your super balance as a basket of eggs. International shares allow you to spread your eggs across different baskets (countries) to minimize the risk of all your eggs breaking if one basket falls (a single economy struggles).

- Reduced Home Bias: Australians often have a natural tendency to invest heavily in Australian assets. International indexed shares help overcome this home bias and provide exposure to a wider pool of potential growth opportunities. Think of it as expanding your grocery shopping beyond just the local supermarket. The international market offers a wider variety of investment options (companies).

Cost-Effectiveness:

- Lower Fees: Indexed funds typically have lower fees compared to actively managed funds. Since indexed funds passively track a market index, they don’t require a team of analysts actively researching and selecting individual stocks. Lower fees translate into more money staying invested in your super, potentially boosting your long-term returns.

Long-Term Growth Potential:

- Historically Strong Performance: Historically, international stock markets have offered competitive long-term returns. While past performance isn’t a guarantee of future results, including international shares in your super can potentially enhance your retirement savings potential.

Alignment with Investment Timeframe:

- Super is a Long-Term Investment: Superannuation is a long-term investment vehicle. The long-term nature of superannuation aligns well with the potential of international stock markets. Stock markets tend to experience fluctuations in the short term, but historically, they’ve delivered positive returns over extended periods. Since you have a long runway until retirement, international shares can potentially weather short-term market dips and benefit from long-term growth.

Important Considerations:

- Market Volatility: International stock markets can be more volatile than the Australian market. This volatility can be unnerving for some investors. However, if you have a long-term investment horizon and can stomach some short-term ups and downs, international shares can be a rewarding investment.

- Hedging: International indexed shares can be offered in hedged and unhedged versions. Hedged options aim to minimize currency fluctuations, while unhedged options expose you to potential gains (and losses) from currency movements. Consider your risk tolerance and investment goals when choosing between hedged and unhedged options.

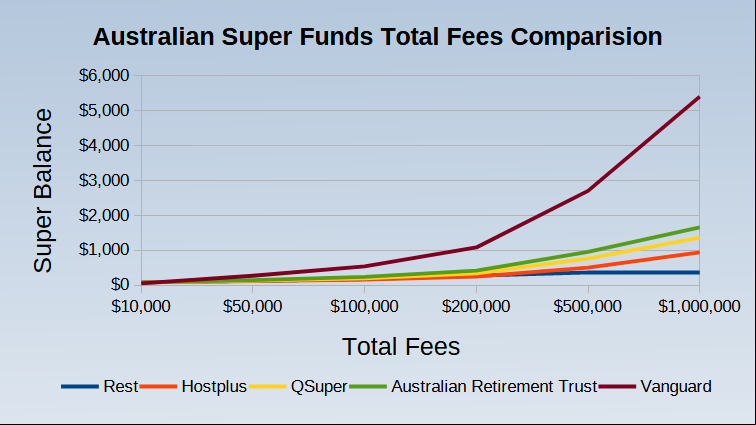

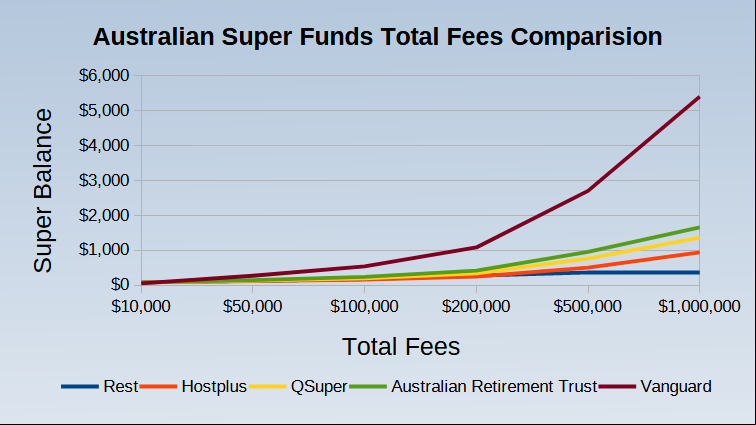

Study Total Fee for Different Super Balances

Now, let’s calculate and explore the total fees for five popular low-cost super funds across different account balances.

| Super Balance | Rest | Hostplus | QSuper | Australian Retirement Trust | Vanguard |

|---|---|---|---|---|---|

| $10,000 | $88 | $87 | $79 | $80 | $60 |

| $50,000 | $128 | $121 | $135 | $152 | $276 |

| $100,000 | $178 | $165 | $205 | $242 | $546 |

| $200,000 | $278 | $251 | $345 | $422 | $1,086 |

| $500,000 | $378 | $511 | $765 | $962 | $2,706 |

| $1,000,000 | $378 | $943 | $1,365 | $1,662 | $5,406 |

Key Takeaways from the Study

The study reveals some interesting insights:

- Vanguard: Stands out for low fees, especially for smaller super balances. For a $10,000 balance, Vanguard boasts the lowest fees by a significant margin. However, as your super grows, the fee advantage diminishes. Imagine Vanguard as a discount supermarket that offers great deals initially, but as your shopping cart fills up, the cost advantage shrinks.

- Rest: Offers a more stable fee structure across different balance levels. This makes it a potentially good option for those with a long-term view and a growing super balance. Think of Rest as a mid-range supermarket with a flat membership fee regardless of how much you buy.

- Hostplus: Similar fee structure to Rest, but with slightly lower fees for some balance ranges. This could be a good option for those seeking a balance between low fees and a stable fee structure.

- QSuper & Australian Retirement Trust: Generally have higher fees compared to the other three options in the table. However, they might offer additional features or benefits that could be attractive to some investors. Consider these options if there are specific investment choices or services that outweigh the higher fees.

Taking Action

Having considered the fee structure of different super funds, here are some steps to get you started with choosing the right one:

- Choose a Super Fund: Go through these super fund options and choose the one that matches your requirement based on how your super balance will grow over next few years.

- Consolidate Your Super: If you have multiple super accounts, consider consolidating them into the chosen super fund. This simplifies your super management and potentially reduces fees.

- Regularly Review: Don’t set and forget! Your circumstances and financial goals might evolve over time, so revisit your super choices periodically to ensure they remain aligned with your needs.