Are you an Australian investor looking for ways to boost your gain?

You might have heard of stock lending as a strategy to generate additional money. But is it worth it?

In this post, I will briefly go through what stock lending is. I will then delve into how to do it as a retail investor (individuals and small businesses) in Australia, and the risks and benefits involved.

What is Stock Lending?

Stock lending is a technique where a lender temporarily transfers shares to a borrower. The borrower provides collateral to secure the deal. The lender then charges a fee based on demand for the shares in the market. Any dividends paid on the shares during the lending period are passed on to the lender.

As explained in the video, Stock lending is an established practice in the financial industry. It has traditionally been used by large institutional investors. However, it is increasingly being offered to retail investors as well.

How to Do Stock Lending as a Retail Investor in Australia?

In Australia, stock lending is still limited to institutional investors and is generally not offered to retail investors. Australian regulators have typically discouraged the use of stock lending by retail investors.

For example, In a 2022 press release ASIC Commissioner Danielle Press warned brokers against wrongly promoting securities lending products.

As a result, stock lending products are unavailable to Australian retail investors.

So to execute this strategy, Australian investors will likely need to invest in non-Australian markets, such as the US markets. The investors can use an Australian broker that allows investing in the US market and offers a stock lending program such as Stake or Interactive Broker. But there is always a risk that Australian regulators can stop these programs if they find any issues.

For example, the Australian Securities and Investments Commission (ASIC) sometime back placed an interim stop order on a securities lending product called Stock Yield Enhancement Program (SYEP). The product was stopped due to concerns about the clarity of the product’s structure and the risks involved.

Alternatively, Australian investors can use US-based brokers that offer services to Australians such as Schwab. This option will be a bit more complex and will need additional paperwork to open and run the account.

Benefits of Stock Lending for Australians

Stock lending has important benefits for investors looking to generate additional income.

1. Extra Income

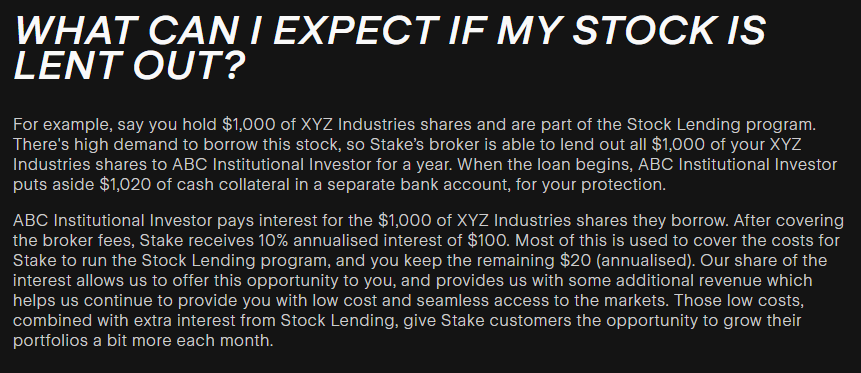

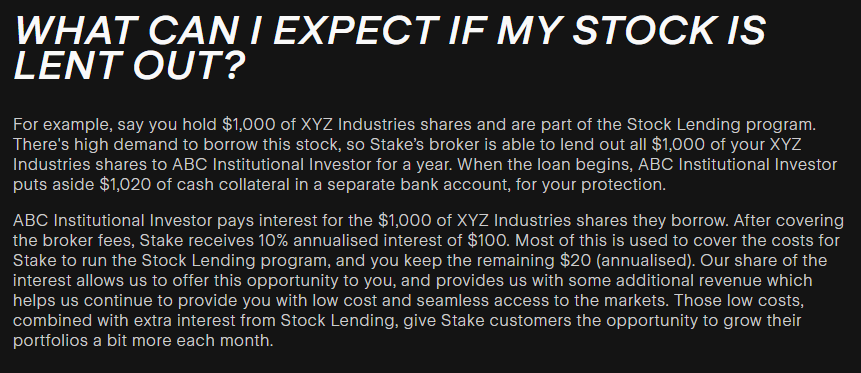

One of the benefits of stock lending is the extra income generated using the fees charged to the borrower. However, the broker takes a cut of these fees. The commission charged by brokers to the lenders can be high.

Also, the yield, especially for good stocks and ETFs, is usually low. This means that the extra income generated might not be worth the cost.

2. Hedge Against Falling Stock Prices

Another benefit of stock lending is that investors can make money during a falling market. Stock lending is usually used for short selling, which can be a useful strategy for borrowers to hedge or make a profit in a bear market.

So, during a falling market, the income received by stock lenders will act as a hedge against the loss of principal.

Risks and Concerns of Stock Lending for Australians

While the likely benefits of stock lending may seem appealing, there are several risks and concerns that investors should be aware of before using this strategy.

1. Counterparty Risk

When lending out shares, there is a risk that the borrower may default on their duty to return the shares. This will leave the lender exposed to a loss.

To mitigate this risk, stock lending transactions typically require collateral to be put up by the borrower, typically in excess of 100% of the value of the lent shares.

2. Collateral Value Risk

Even with collateral, there is still a risk that the value of the collateral may fall below the value of the shares. This can leave the lender with a loss.

This risk is usually mitigated by the daily requirement to meet collateral value, but it could still be a risk if the market suddenly changes drastically and borrowers fail to get additional cash for collateral.

Also, the collateral is sometimes reinvested in short-term securities, which can have the risk of losing value. This means that the collateral might not be as safe as investors believe.

3. Impact on Stock Price

By allowing short sellers to borrow shares, stock lending can raise the supply of shares available for sale in the stock market.

This rising supply can create additional downward pressure and drive down the price of the stock, potentially driving losses for long-term shareholders.

4. Lack of Transparency

There is a lack of transparency for retail investors in the stock lending technique, with many investors clueless about how and to who their shares are being lent out or how the collaterals are being managed.

This lack of transparency can make it hard for investors to assess the risks and rewards of the strategy.

5. Tax Implications

In stock lending transactions, dividends paid to the lender are substituted with ordinary income payments, which can have different tax treatments.

For example, if there was a franking benefit on a share, it will not be usually available to the stock lender.

6. Loss of Voting Rights

When shares are lent out, the lender generally loses their voting rights for the duration of the loan.

This loss of voting rights may be an important concern for long-term shareholders who want to have a vote in company decisions.

7. Lack of Industry Insurance

In the event of a broker failure, investors who have lent out their shares may not be secured by some of the protections.

For example, Investing in US shares will not be protected by the Securities Investor Protection Corporation (SIPC), which provides up to $500,000 of insurance protection per account for brokerage failures.

8. High Cost

The fees charged by brokers are usually high ranging from 50% (e.g., TD Ameritrade and Schwab) to as high as 80% (e.g., Stake).

Also, the return on popular stocks and ETFs is either very low or may not be available for retail investors. This means that the additional cash generated by stock lending might not be worth the cost.

9. High Complexity

While the process of enrolling in a stock lending program is usually straightforward, the underlying complexities of the transactions can make it challenging for retail investors to assess the risks and rewards of the strategy.

As with many risky strategies in the past, there is a risk that a bubble could be formed. If there is a systematic risk in future, the bubble could burst, impacting everyday investors the most.

Is Stock Lending Worth the Risk for Australian Investors?

Considering the potential risks and concerns, is stock lending worth it for Australian retail investors? In my opinion, the answer is no.

The lack of transparency, potential tax implications, and high fees make it unappealing for most investors. While it may create an extra source of income, the risks associated with stock lending outweigh the benefits.

Conclusion

In conclusion, stock lending is not a strategy that I recommend for Australian retail investors. While it may be irresistible to earn some additional cash, the risks are simply too high.

Instead, I suggest exploring other investment strategies that are more transparent and less risky.

Remember, it’s critical to do your own research and consult with a financial advisor before making any investment decisions.